ECIT F&A Tech AS is a leading Nordic company delivering IT solutions, financial management services, and accounting tools, with a strong focus on innovation and compliance. ECIT KYC, one of its cutting-edge RegTech solutions, is designed for financial institutions and enterprises, simplifying AML compliance. The platform streamlines KYC processes with real-time data, European eID authentications, and secure reporting, delivering a modern, efficient experience for users while supporting businesses in navigating complex regulatory requirements.

about project

Project Overview

Challenge

ECIT F&A Tech AS, established in 2013, has consistently aimed to empower its clients by simplifying complex business processes, including regulatory compliance and financial management. Understanding the continuous evolution in global financial regulations, ECIT F&A Tech sought to provide a robust solution that would:

- Simplify AML compliance for businesses.

- Enable secure, real-time verification of entities.

- Provide reliable, audit-ready reporting.

The challenge was to create a scalable, modern platform capable of meeting these demands effectively, integrating the latest technologies to ensure compliance and enhance user experience.

Solution

Selleo partnered with ECIT F&A Tech to deliver a tailored KYC (Know Your Customer) platform, focusing on security, efficiency, and user experience. The solution included:

- Real-Time Data Integration: Seamless verification of entities using up-to-date data.

- Secure Authentication: Integration of Nordic BankID for secure user verification.

- Scalable Infrastructure: A flexible, API-driven architecture built with modern technologies like microservices and containerization.

- User-Centric Design: Development of intuitive interfaces for administrators and end-users to simplify compliance workflows.

Outcome

The collaboration resulted in a robust web application that:

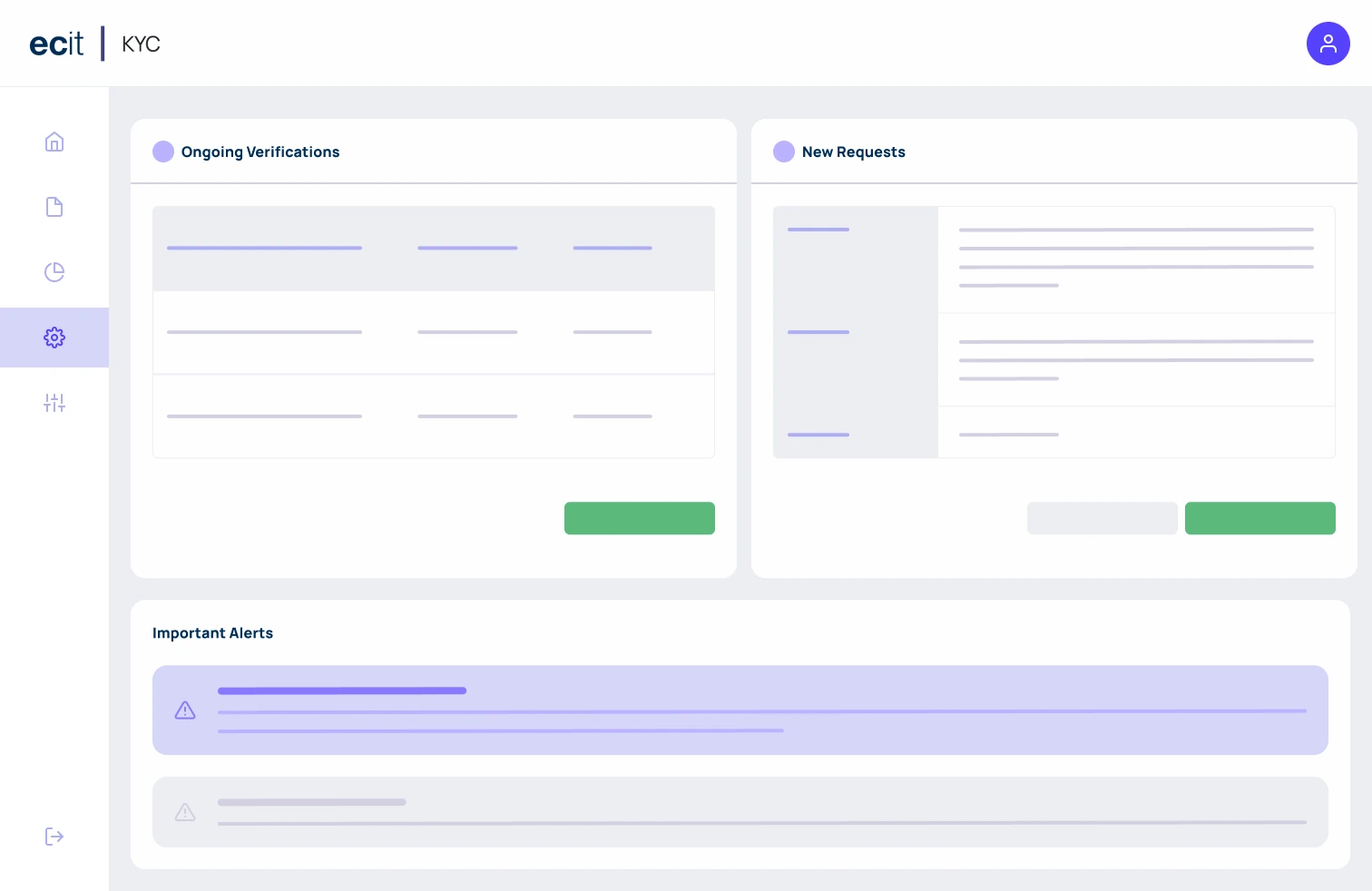

- Improved Compliance Efficiency: Streamlined KYC processes and reduced manual effort.

- Enhanced Security: Ensured reliable, secure authentication for businesses.

- Delivered Audit-Ready Reporting: Provided transparent and accurate AML compliance reports.

- Increased User Satisfaction: Intuitive design improved usability, enabling businesses to navigate regulatory requirements with ease.

By combining cutting-edge technology with client-focused development, ECIT KYC now empowers enterprises to meet AML compliance demands confidently and efficiently.

our role

Scope of our work

We partnered with ECIT F&A Tech AS to transform their vision into a secure and efficient KYC RegTech platform that simplifies complex compliance challenges. From concept to development, we worked closely to understand their goals and deliver a solution tailored to their needs. By integrating European eID authentication for trusted identity verification, implementing real-time data processing for accurate insights, and designing an intuitive interface, we created a tool that not only enables compliance but gives businesses peace of mind. The result? A platform that empowers enterprises to navigate regulations confidently and focus on what matters most—growth and success.

Business Value

Simplify Compliance, Enhance Trust

ECIT KYC empowers enterprises with a secure, efficient solution to simplify regulatory compliance. The platform streamlines AML processes and BPO verification, delivering actionable insights and reducing manual work. By simplifying KYC workflows, it saves time, lowers costs, and provides businesses with the confidence and peace of mind to meet regulatory demands effortlessly.

Key Features:

- BankID: Verify user identities with trusted, bank-level security.

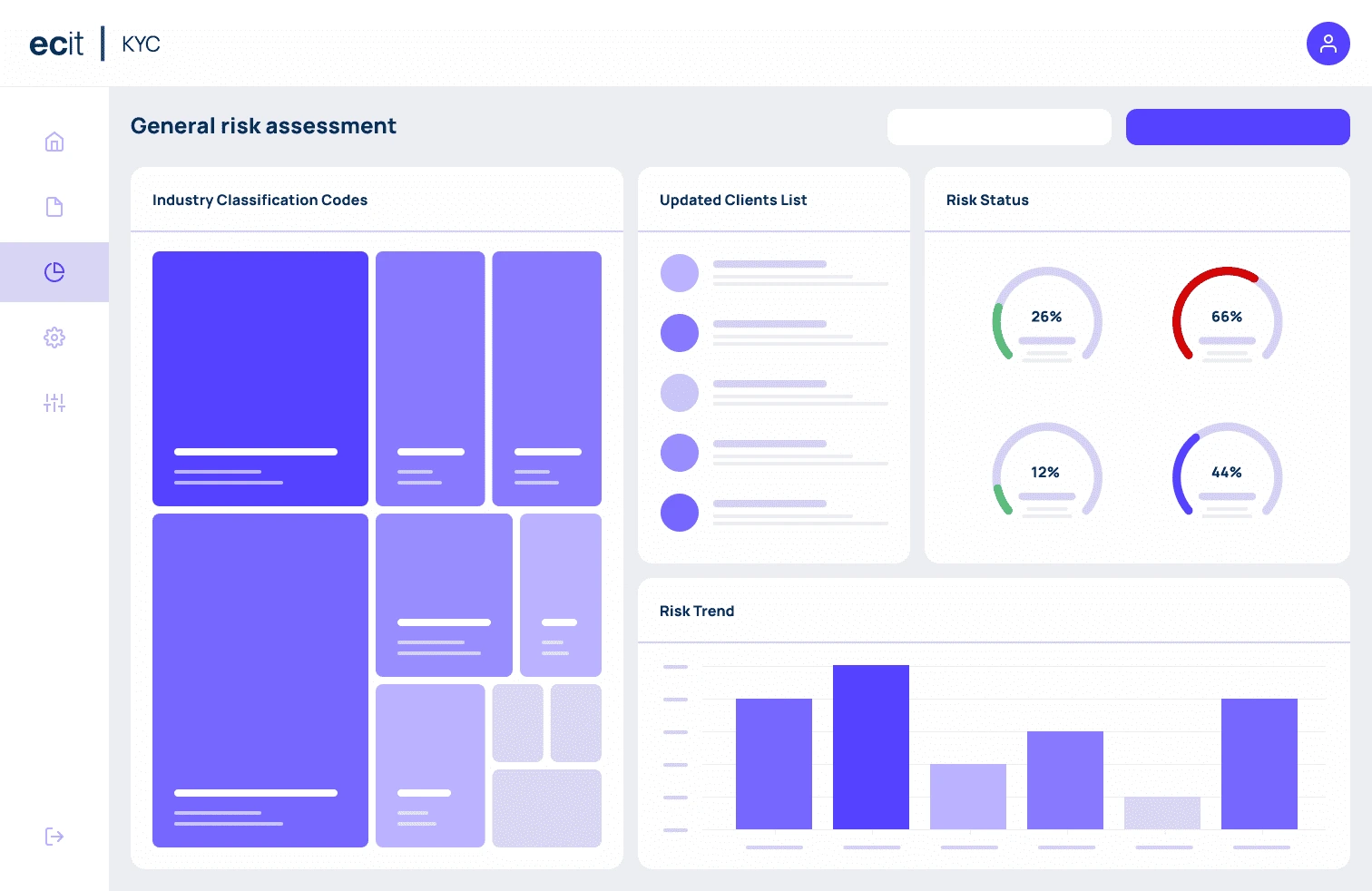

- Real-Time Data Integration: Access accurate, up-to-date business verification data instantly.

- Streamlined KYC Processes: Replace tedious paperwork with an intuitive, transparent interface.

- Comprehensive Reporting: Generate AML-compliant, audit-ready reports with ease.

- Seamless Integration: Connect with existing systems for a unified and efficient experience.

Please note: These are design concepts illustrating the solution’s direction and user flow, not the system’s exact functionalities.

Check out the next project